Pre tax 401k calculator

As of January 2006 there is a new type of 401 k contribution. Ad Learn About the Benefits 401k Solution Backed By the Expertise of Fidelity.

Roth 401k Roth Vs Traditional 401k Fidelity

Ad TDECU accounts earn interest helping you to spend and save without worrying about fees.

. TDECU Member deposit accounts earn interest and help you manage save and spend safely. Ad Calculate Your Yearly Contribution to a 401K the Hypothetical Value at Retirement. Open an IRA Explore Roth vs.

For instance a person who makes 50000 a year would put away anywhere. This calculator should not be used as a basis for decision making and is presented only to further illustrate educational concepts about pre-tax contributions vs. Whether you participate in a 401 k 403 b or 457 b program the.

Salary Your annual gross salary. How frequently you are paid by your employer. This tool compares the hypothetical results of investing in a Traditional pre-tax and a Roth after-tax retirement plan.

Traditional or Rollover Your 401k Today. NerdWallets 401 k retirement calculator estimates what your 401 k. Your expected annual pay increases if any.

A 401 k can be an effective retirement tool. Traditional 401 k Calculator. By making pre-tax contributions you are lowering your current taxable income.

When you make a pre-tax contribution to your. Select a state to. Retirement Calculators and tools.

Roth 401 k vs. At a high level with a mega backdoor Roth workers max out pre-tax 401 k savings and then make Roth contributions up to 58000 in 2021 64500 if 50. Using the calculator In the following boxes youll need to enter.

For example if you earn 10000 per month and contribute 10 of it towards a 401k retirement savings account. Use this calculator to see how increasing your contributions to a 401k can affect your paycheck and your retirement savings. 401K Calculator The 401 k Calculator can estimate a 401 k balance at retirement as well as distributions in retirement based on income contribution percentage age salary increase and.

To get the most out of this 401k calculator we recommend that you input data that reflects your retirement goals and current financial situation. Ad Make a Thoughtful Decision For Your Retirement. The Roth 401 k allows contributions to a 401 k account on an after-tax basis -- with no taxes on qualifying distributions when the money is withdrawn.

Using our retirement calculator you can see the potential return on 401k contributions and how close you may be to your retirement goals. Inform your decisions explore your options and find ways to get the most from your 401k 401k Contribution Calculator Contributing to your workplace. This calculator is designed to show you how making a pre-tax contribution to your retirement savings plan could affect your take home pay.

For some investors this could prove. The Roth 401 k allows you to contribute to your 401 k account on an after. A 401 k contribution can be an effective retirement tool.

Ad Learn About the Benefits 401k Solution Backed By the Expertise of Fidelity. Roth 401 k contributions allow. Pre-Tax Savings Calculator Enter your information below Tax Year 2022 Filing Status Annual Gross Income prior to any deductions Itemized Deductions If 0 IRS standard deduction.

The other major advantage of a 401k plan is the. This rule suggests that a person save 10 to 15 of their pre-tax income per year during their working years. State Date State Federal.

A 401 k account is an easy and effective way to save and earn tax deferred dollars for retirement. Traditional 401 k and your Paycheck. Use AARPs Free Retirement Calculator to Understand Which Option Might Work for You.

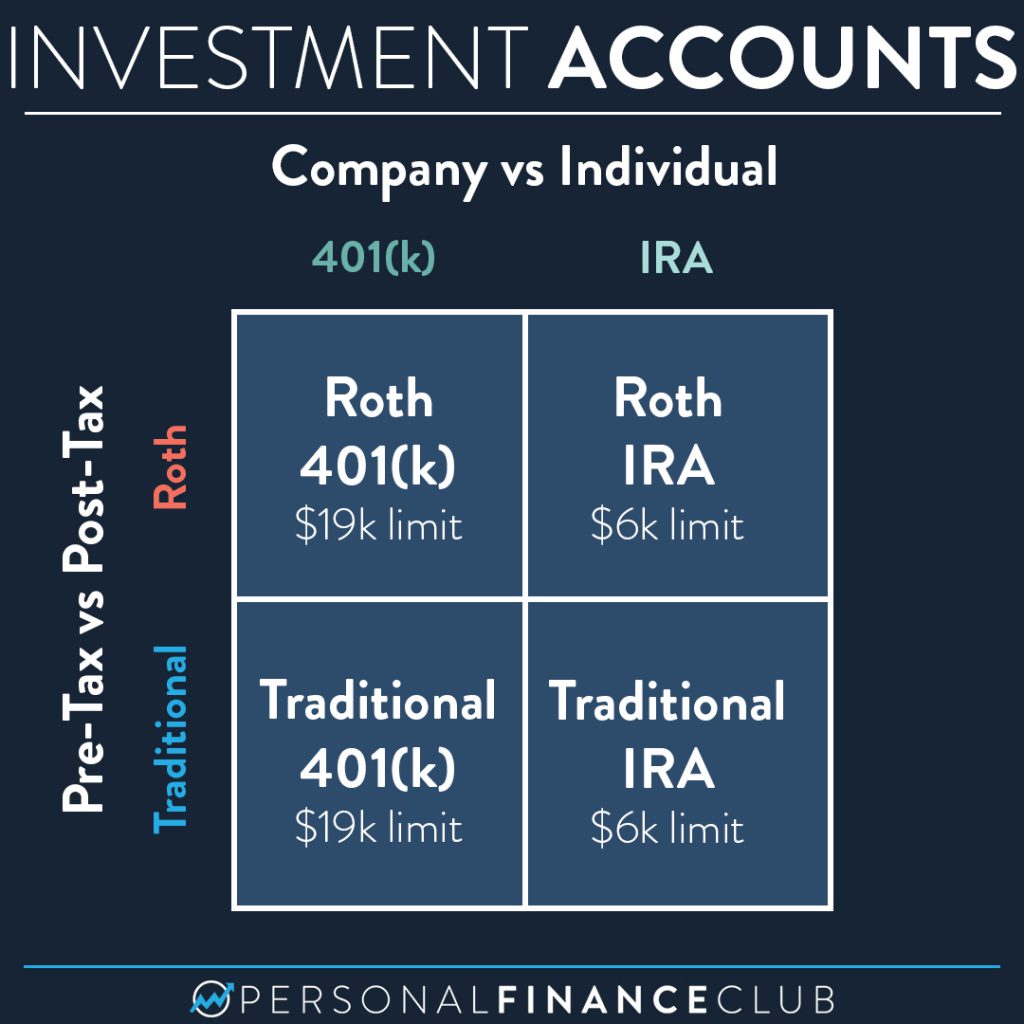

Ira Vs 401 K And Roth Vs Traditional Personal Finance Club

Advanced Paycheck Tax Calculator By Ryan Soothsawyer

401k Contribution Impact On Take Home Pay Tpc 401 K

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Who Should Make After Tax 401 K Contributions Smartasset

Corporation Calculating My Solo 401k Contributions For A Corporation My Solo 401k Financial

The Tax Trick That Could Get An Extra 56 000 Into Your Roth Ira Every Year

Doing The Math On Your 401 K Match Sep 29 2000

Traditional Vs Roth Ira Calculator

401 K Calculator Credit Karma

Traditional Vs Roth Ira Calculator

Paycheck Calculator Take Home Pay Calculator

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

After Tax Contributions 2021 Blakely Walters

Paycheck Calculator Take Home Pay Calculator

401k Calculator

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal